2023 has proven to be a year of captivating shifts and noteworthy trends for D2C alcohol. Here at Tipple, we've observed it all firsthand, thanks to our unique vantage point. Our close ties with brands in the industry have allowed us to compile data from across Europe to learn more about the key trends that have shaped this year.

From the surging growth of D2C and omnichannel strategies to the emergence of new drink preferences across the continent, alcohol brands have become increasingly creative to stay ahead of the competition.

Europe’s palates are evolving

When it came to changing tastes and alcoholic beverage preferences, the spotlight this year was undeniably on Germany, Austria, France and The Netherlands.

Germany and Austria led the way in embracing tequila, showcasing a 30% year-over-year growth in overall sales for brands. The two regions also had the highest amount of repurchases for tequila spirits across all of Europe.

Denmark is fast becoming synonymous with its rum enthusiasts. The Tipple data showcases a fascinating trend: consumers aren't just buying single bottles; they're coming back for more! The average rum buyer is purchasing 4.6 bottles annually.

In France, consumers are reaffirming their love affair with Scotch. French consumers purchased an average of 3.1 bottles over the year with a preference for single malt products.

Prosecco and bubbly are on the rise

Although sales for traditional champagne are similar to the previous year, prosecco is making waves. The data reveals a noteworthy 26% uptick in prosecco consumption, pointing towards a broader trend of consumers seeking lighter, more versatile options.

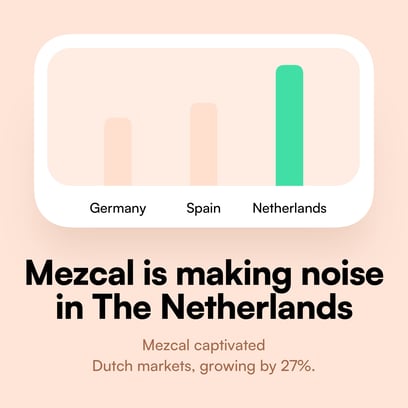

Mezcal is making noise in The Netherlands

Mezcal's smoky flavours have been embraced by Dutch consumers, leading to an impressive 27% growth for the category. Premium brands were at the forefront of this change, with 16% of buyers opting to buy a premium mezcal beverage.

D2C emerges as a driver for growth

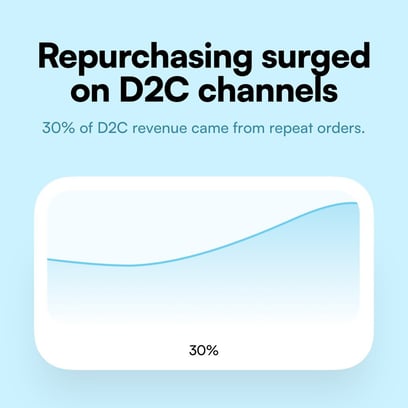

D2C has become a crucial element in a successful omnichannel strategy for brands. The median number of brands are driving, on average, 25% of their revenue and 50% of their profit through the Tipple platform. The data has also shown that aside from driving direct sales, D2C channels have been pivotal in contributing to extra sales on B2B channels and, as a result, have become a popular route to market for brands.

Repurchasing is a huge contributor, as 30% of the overall D2C revenue was generated from repeat orders. Our experts predict that this trend will continue throughout the new year as consumers continue to diversify how they purchase their favorite beverages.

Final thoughts

As we enter the new year, one thing is abundantly clear - it's the beginning of a wave for D2C alcohol. While some markets and trends are still emerging, the growth indicators we’ve seen in 2023 are impressive.

We’ve seen this reflected in the growing interest for Tipple across the continent throughout the year. A special thank you to all the brands that have joined us on this exciting journey. One of our highlights was seeing extra sales generated and the remarkable growth.

To stay ahead of the competition and capitalise on D2C opportunities, we recommend that you partner with the right experts who can help you navigate and profit from D2C. To learn more about how to seize the momentum, speak to our team.

2023 has proven to be a year of captivating shifts and noteworthy trends for D2C alcohol. Here at Tipple, we've observed it all firsthand, thanks to our unique vantage point. Our close ties with brands in the industry have allowed us to compile data from across Europe to learn more about the key trends that have shaped this year.